Impact of Potential Funding Cuts on U.S. Green Energy Firms

The future of green energy in the United States hangs in the balance as the government grapples with potential funding cuts. This situation is significant not only for domestic renewable energy firms but also in the context of a global shift toward sustainable solutions. As countries worldwide move toward cleaner energy, the ability of American companies to compete and innovate may depend heavily on the political climate surrounding federal subsidies and tax credits.

At the heart of this issue is the evolving landscape of federal financial support for clean energy technologies. Companies like HIF Global, which is developing a $7 billion e-methanol factory in Texas, rely on tax credits tied to clean hydrogen production for their projects' viability. These credits lower operational costs, making U.S. products competitive against international counterparts, particularly from countries with robust clean energy investments like China. However, recent legislative proposals aim to scale back or eliminate these financial incentives, throwing into jeopardy countless projects and stalling the momentum in the clean tech sector.

A real-world illustration of this dilemma can be seen with the ongoing uncertainty around the Inflation Reduction Act and the Infrastructure Investment and Jobs Act. Many green energy initiatives are fueling job creation and significant technological advancements. However, if these funding streams dry up, as suggested by recent legislative actions, it could lead to stagnation and cancellations of new projects, as firms re-evaluate their investment strategies. For instance, in early 2025, a sharp decline in clean energy investments was reported, alongside the cancellation of six major manufacturing projects essential to the sector’s progression. This paints a sobering picture of how policy changes can create ripples of stagnation throughout the industry.

In summary, the fate of U.S. green energy firms is closely tied to federal funding decisions, which reflect broader political and economic trends. As the Biden administration navigates these complex discussions, critical questions arise: What will be the long-term impacts of potential funding cuts on America's competitiveness in the global green energy market? How might the shift towards a more favorable policy environment be achieved? For those looking to explore this topic further, monitoring the outcomes of the current budget proposals and understanding their broader implications is advisable.

Read These Next

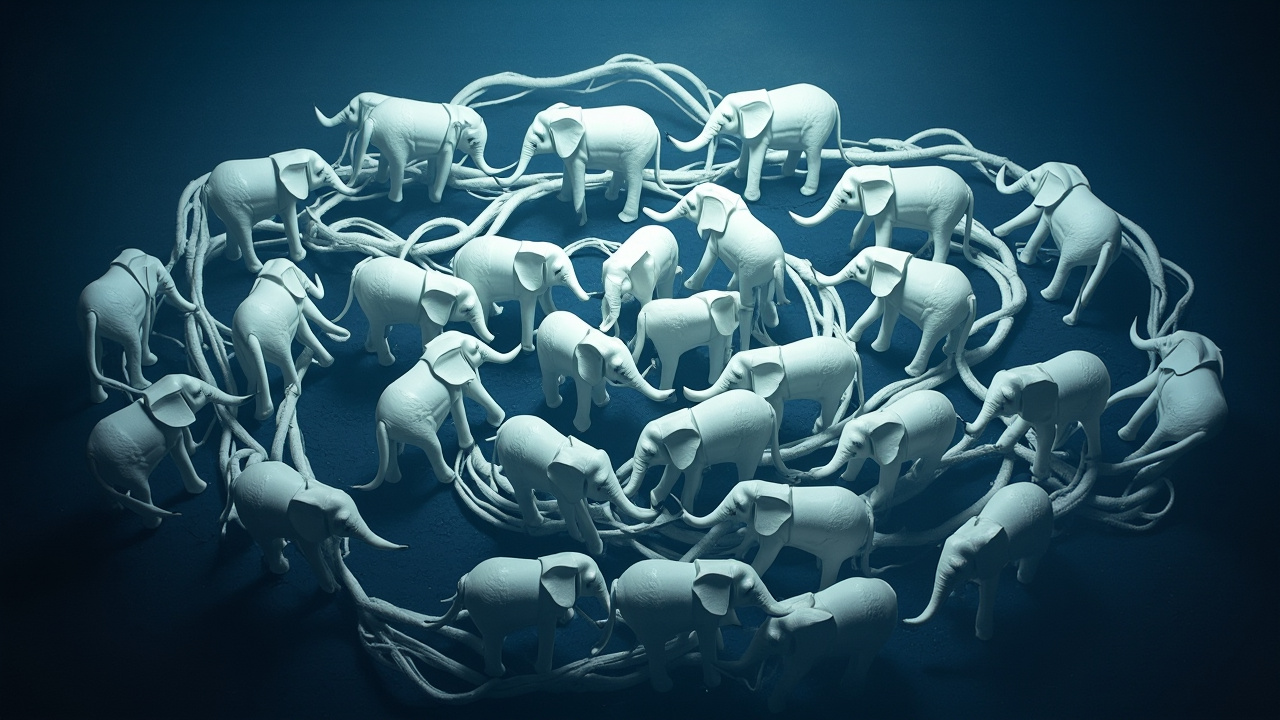

White Elephant Trademark Dispute Intensifies Again

Baixiang Food's "mostly half" packaging sparked a trademark dispute, raising concerns over brand transparency and marketing ethics.

Consumer Reactions to the Nintendo Switch 2 Launch

This article explains the significance of the Nintendo Switch 2 launch, highlighting consumer behavior and marketing strategies,

Blue Whale Sightings Surge: What You Need to Know!

Zhimiya faces scrutiny for a promo video allegedly infringing Shaanxi Aierskin's patent, highlighting IP protection importance.